YOU, IN WHITE STUFF

🌐【全球数据】幸运飞行艇开奖结果统计|极速飞艇官方号码+历史记录|168平台 A LITTLE BIT ABOUT WHITE STUFF

幸运飞行艇/极速飞艇开奖结果全球数据统计,新飞艇2025官方号码+历史开奖记录查询结果!168飞行艇平台提供极速飞艇实时分析、预测软件下载、人工计划查询! We make distinctive clothes, designed in house, with an obsession for quality, sustainable fabrics, great fit, and those unique little details that matter. Because life would be dull if we all looked the same.

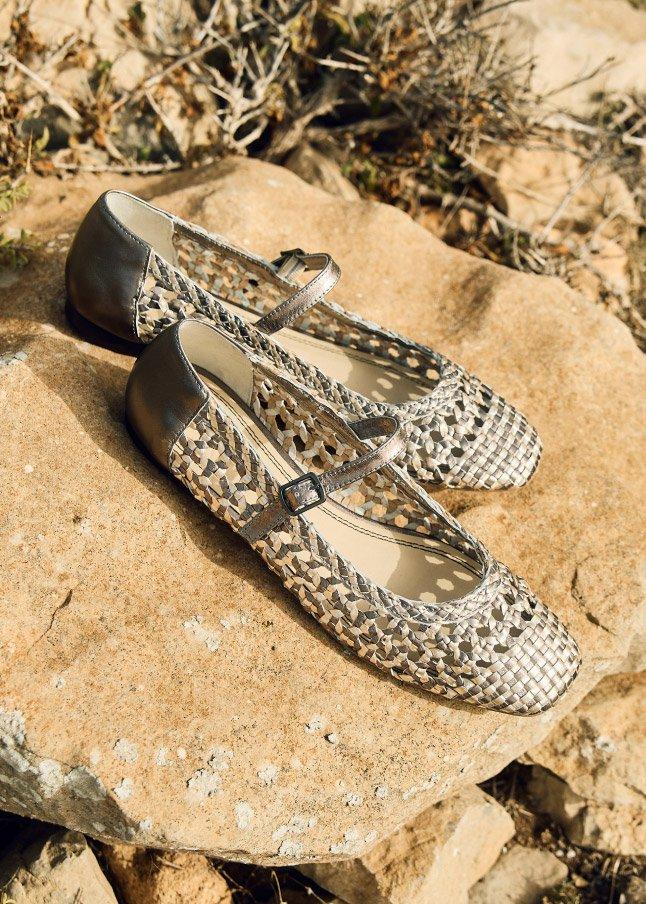

We make women’s clothing, men’s clothing, footwear and accessories too. We’ve got summer dresses in easy-to-wear silhouettes that you can dress up or down. Petite dresses too so you can get just the right fit. Separates likes linen trousers and women’s t-shirts for mixing and matching. And our White Stuff linen dresses, with the shoes and bags that finish off an outfit.

At the heart of White Stuff, we’re about trying to do the right thing by the planet and its people. We’ve always tried to use more sustainable materials wherever we could. According to Fairtrade, White Stuff is currently the UK’s biggest fashion retailer of Fairtrade Sourced Cotton. We donate at least 1% of our profits to charity every year, and we also like to champion our community by celebrating our customers in our marketing campaigns.

In our White Stuff online shop, you’ll find the latest collections, inspiration and interesting things to read (and of course the White Stuff sale). We hope you like what you find.